Medicare Education

Traditional Medicare Parts A & B

When you are turning 65 your start hearing all this stuff about parts A & B. What is that all about? Part A is often referred to as your, “Hospitalization Benefit” it actually covers the following.

- Inpatient care in hospitals

- Skilled nursing facility care

- Hospice Care

- Home Health Care

Part A is what you paid for while you were working. For Part B there is a monthly premium for most people that will be 164.90 in 2020. Part B is often referred to as your “Doctor Benefit” it works like 80/20 co-insurance where you pay the 20%. It covers essentially covers the services required to diagnose your conditions and pay the doctors.

Services from doctors and other providers

- Outpatient care

- Home Health Care

- Durable Medical Equipment

- Some Preventive Services

These two Parts are what is referred to as Traditional (some people will say “Original”) Medicare.

Part D plans and Supplements

Though Medicare has been around since 1965, Part D plans only came into fruition in 2006. Now when you are turning 65 you need to pick a Part D plan (Drug Plans). These plans cover your outpatient prescriptions (that is prescriptions you generally take at home). Every plan is required to have choices in its formulary (that is the list of drugs it covers) in every therapeutic category.

You do not have to have a Part D plan, but if you do not you end up growing a penalty. Once you get a Part D plan that penalty is monthly (not a one time payment) and it will stay with you until you are no longer in the Medicare system.

Supplements (also called Medigap) fill in the gaps in coverage of traditional Medicare. Supplements can pay the deductibles, co-insurance, and even excess charges. It all depends on which supplement you choose. Medicare Supplements all have different letter designations. For instance, there is a “G” supplement and an “N” supplement (There is a complete chart in the article below).

A Medicare supplement is what is known as a defined benefit plan. What that means is that one company’s “G” is the same as every other companies “G.” So you are shopping for 3 things. First, which supplement you want. The second, the initial cost. Third, the company’s history of rate stability.

Medicare Advantage Plans

A question I often get from people turning 65 is, “What is the advantage of an “Advantage Plan?” The simple answer is that is is less expensive. Most companies now offer plans that have $0 premium (we cannot say it’s free…to be compliant with the rules we have to say it has a “zero dollar premium”. Medicare Advantage plans operate more like a traditional health insurance plan so it just feels more familiar to a lot of people.

Advantage plans often have a lower monthly price and generally, your out-of-pocket costs are fairly moderate. You do need to keep an eye on your out of pocket maximums though.

Keep in mind you have to pay your Medicare Part B premium of $164.90 (in 2023) even if you have an Advantage Plan.. After that what you pay for the Advantage plan could be $0. For $0 you could have a plan that really does have very reasonable out-of-pocket costs for most procedures and services. That’s not bad for $0.

Not all plans are $0 premium plans (There are plans with premiums over $100), but those with a $0 premium attract a lot of people. My advice, in general, is to look at the out-of-pocket maximums after you confirm that your doctors are in-network and your prescriptions are covered.

Turning 65? How do you apply for Medicare?

First, how do you get Medicare? Do you have to sign up or does it happen automatically?

If you are already receiving Social Security or are on disability, then you will be automatically enrolled.

[1] If you do not fall into one of those categories you can apply for benefits at SSA.gov, by calling 800.772.1213, or by visiting your local Social Security office.

The soonest you can sign up is three months before the month of your 65th birthday. (example: If your birthday is in November the soonest you could sign up is August)

Signing up online is really easy. Just click on “Medicare” in the blue bar at the top of the SSA.gov page and choose the 2nd option down which is “Sign up for Medicare.”

Traditional Medicare

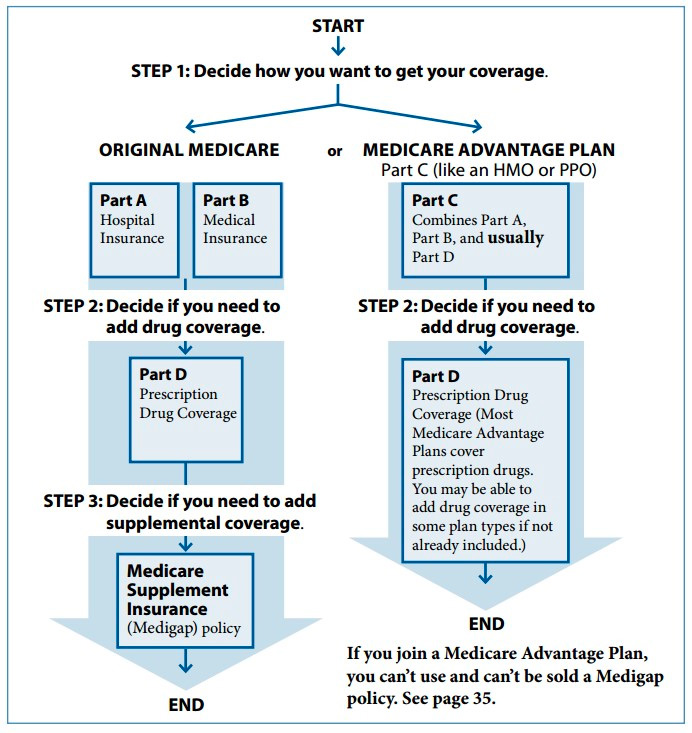

Your first option is traditional Medicare (sometimes called Original Medicare) which has Parts A & B (this is the left side of the flow chart).[2] Traditional Medicare has no networks. You can go anywhere in the nation that accepts Medicare. This is one of the biggest benefits of traditional Medicare. If a doctor accepts Medicare then they also take any supplement from any supplement company.

Part D is your drug plan (pharmacy benefit). Part D plans are managed by insurance companies that have contracts with CMS (The Center for Medicare and Medicaid Services) and follow certain guidelines. Every plan is required to have a formulary (the list of drugs covered) with drugs in every single therapeutic. They don’t all have to have every drug in every category, but something. You are not required to get a drug plan, but if you don’t there is a penalty.

Medicare supplements step in and help pay deductibles, co-insurance, and/or give Medicare and “Out of Pocket Maximum.” You get to choose which supplement you want. They are what is called, “defined benefit plans.” What this means is that a “G” supplement (for instance) has the same benefits regardless of what company you get it from.

Advantage Plans

Advantage plans (the right side of the flow chart) are offered by insurance companies that have contracts with CMS. They kind of bundle together Parts A, B, and generally D as well. Quite often, (but not always) Advantage plans offer extra coverage such as dental and vision that traditional Medicare does not cover. When choosing plans please note that the extra benefits vary from company to company and year to year.

With Advantage plans, the doctors and hospitals are paid by the insurance companies, not by Medicare. Advantage plans, just like a regular health insurance policy have networks. Networks are generally state-based, but there are no networks for emergency care.

Turning 65? Let’s dive a little deeper into Parts A & B

Part A is generally referred to as “Hospital Insurance” as mentioned above. If you think back to one of your paycheck stubs you would have seen a line item for “Medicare.” Well, that was your part A premium you were paying. Once you are turning 65 and enroll in Medicare you generally won’t have to pay that anymore! That’s a good thing.

Part B is referred to as “Medical Insurance.” It will cover the medical services needed to diagnose and treat your health issue. In addition, it will cover preventive services, durable medical equipment, second opinions before surgery, and more.

Part B does have a premium and most people will have to pay $144.60 a month in 2020. Higher-income earners may have to pay more and lower-income earners may be eligible for extra help. The Part B premium ($144.60 a month) does have to be paid regardless of whether you choose to stay with traditional (original) Medicare or go with an Advantage plan.

Part A & B Coverage

Now that you have an idea about costs, let’s talk about coverage. First, the deductibles. Part A has a $1408 deductible for the services it covers. That deductible will cover between 1 to 60 days of care.

It’s important to note that this is a per-incident deductible, not per year. It is rare that a person would be admitted to a hospital multiple times in one year, but it does happen, so you need to be aware of that. Part B has an annual deductible of $198 in 2020 and after that, it pays out 80/20.

Turning 65? Guaranteed Issue Medicare Supplements

I like Medicare Supplements. I think traditional Medicare with a Supplement is just better quality insurance. You have no networks. You are not subject to as many pre-approvals or utilization reviews.

There are other differences between Medicare Supplements and Advantage plans. One of the key issues is that Medicare supplements are generally medically underwritten. That is they can ask questions about your health and if you cannot answer to their satisfaction they do not have to give you a policy.

EXCEPT when you are turning 65! When you are newly eligible for Medicare you are guaranteed an issued policy. That means you could have all sorts of health issues and they cannot even ask! So if you have health issues then this is the best time to get on traditional Medicare with a supplement.

Can I move back and forth from a Supplement to an Advantage Plan?

The answer is…maybe. Let us pretend you have been in Medicare for a while and you have either a supplement or Advantage plan (for this example it doesn’t matter which) and you want to move to a different company with a lower rate or you are moving from Advantage to Traditional Medicare. Now you have to apply for that supplement and answer health questions. That is, you have to be underwritten.

Now they can ask what medications you are taking when the last time you were in the hospital was, or if you are insulin-dependent diabetic. Different companies will ask slightly different questions and they will approve you or set your rate based on those answers.

Often people can make the move. There are plenty of companies that accept underwritten applications every day. They also reject applications every day. So, can you move back and forth? Sure…if you get accepted based on your health history.

How do Medicare Advantage Plans work?

Medicare Advantage Plans are offered by insurance companies that have contracts with CMS (The Center for Medicare and Medicaid Services). What they do is to bundle Parts A, B, and (generally) D into a policy that looks more like a normal health insurance policy. Medicare Advantage Plans will have networks and you need to make sure you are seeing in-network doctors and using in-Network facilities.

With Medicare Advantage the insurance company, not Medicare, is paying the doctors & hospitals. What you pay is generally a series of co-pays. It varies company by company and policy by policy.

The monthly cost of Medicare Advantage plans (the premium) is generally lower than what you might pay for separate coverage through Traditional Medicare, Part D, supplement and Dental plan, but you might pay more out of pocket. In general, the Out-of-Pocket-Maximums will be significantly higher.

Details to know about Advantage Plans

You have to stay in Network. With some plans, you might have no or very little coverage for out-of-network charges. Networks are generally state-based as Insurance is generally a state-regulated product. Some companies have reciprocal agreements with some of their networks in some other states.

There are no networks for Emergency care. If you are out of state on vacation and have a car wreck or heart attack… there are no networks for that. If you are out of state and just have the sniffles…that’s not an emergency.

Advantage plans often have “extra” benefits such as dental care. The problem is those benefits can change from year to year.

Utilization reviews are used extensively with Advantage plans. That’s when your doctor wants to do something and can’t get it approved with the insurance company.

Your out-of-pocket Maximums could be really high (close to $7000).

This is a financial decision

Everything is on that continuum. More premium, less out of pocket OR Less premium, more out of pocket.

One of the biggest decisions you will have when you are turning 65 is whether to go with Traditional/Original Medicare or to go with a Medicare Advantage plan. So…what is the difference?

Very loosely, one key difference is your “financial exposure.” That is to say, if something bad happens to your health how much do you end up paying? With a “G” Medicare supplement your effective out-of-pocket maximum is $198 (In 2020…all these numbers change a little from year to year). Advantage plans have a legal limit on their out-of-pocket maximums of $6700. The national average is about $5500, but some are lower. Generally, the less you pay in premium the bigger your out-of-pocket maximum will be.

Turning 65? Case Studies on making Your Medicare Choices

I tell people all the time what you should get depends on your finances…not your health. Your health WILL change. For most of us, our finances in retirement don’t change much at all. Let me tell you the story of two retirements and how the differences drove choices in Medicare.

Client #1 had little income for retirement, only Social Security. However, they did have some money from savings. Because they had little income; they could not afford the higher monthly cost of a separate Part D (drug plan), Medicare supplement, and dental plan. Their monthly budget drove them to the lower premium of the Medicare Advantage plans. For years when there was a higher out-of-pocket cost, they did have savings to fall back on to cover those costs. So, the Advantage plan fits their financial circumstances.

Client #2 had a solid retirement income with Social Security, a pension, and an annuity. What they didn’t have were any savings to fall back on at all. This client could not handle unexpected out-of-pocket costs that might come with an Advantage plan. They did have more than enough income to cover the cost of traditional Medicare, part D plan, supplement, and dental coverage. For this client, Traditional Medicare was the best choice.

Turning 65? What is your agent’s motivation?

By way of disclosure, Insurance Agents make more commission on Medicare Advantage plans. If you talk to 10 agents probably at least 8 will tell you that Advantage plans are the best thing since sliced bread. The drawbacks to Advantage Plans are; 1. Networks, 2. Extra Benefits (such as dental) may change from year to year, 3. Aggressive use of “Utilization Reviews” (that’s where your doctor wants to do one thing, but your insurance company might think it’s too expensive or unnecessary), 4. Possibly higher out-of-pocket Maximums.

Though I’m not a fan of Advantage plans I would still say that almost everything inside Medicare is better than most everything outside Medicare. So if you want an Advantage Plan we will find you the best one we can. There are a lot of choices. I’ll be glad to walk you through all your options. Just give me a call and we can set up a time to meet. I get paid by the insurance companies and they charge you the same rate whether you buy from them directly or have me help you. You might as well give me a call.

[1] There are a few other categories that will be auto-enrolled, such as people with ALS (see Medicare.gov for details).

[2] You can also find this chart in the CMS publication, “Choosing a Medigap Policy: A Guide to Health Insurance for People with Medicare.”